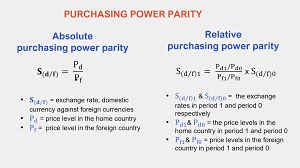

Absolute Purchasing power Parity

Absolute Purchasing power Parity

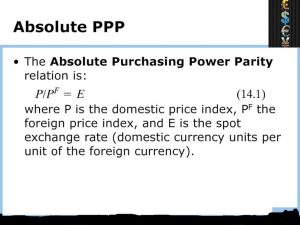

Absolute purchasing power parity (APPP) is the essential PPP hypothesis, which expresses that once two monetary forms have been traded, a bin of products ought to have a similar worth. Generally, the hypothesis depends on changing over other world monetary standards into the US dollar. For instance, if the cost of a container of Coca Cola was $1.50, APPP would recommend that a jar of Coca Cola in some other nation ought to cost $1.50 after you’ve changed over USD into the neighborhood cash.

Introduction to Absolute Purchasing Power Parity

The Absolute Purchasing Power Parity is a central idea in worldwide financial matters that places that over the long haul, the conversion scale between two monetary forms will conform to mirror the general value levels of a container of labor and products in the two nations. This hypothesis proposes that indistinguishable products ought to have a similar cost when communicated in a typical cash, killing the benefits or disservices that might emerge due to varying nearby cost levels. While the hypothesis is clear in its reason, its down to earth application is perplexing and complex, impacting different parts of financial hypothesis, strategy, and worldwide exchange.

Historical Context of Absolute Purchasing Power Parity

One of the earliest verbalizations of this idea was by the Swedish market analyst Gustav Cassel in the mid twentieth hundred years. Cassel’s work arose during a period set apart by huge variances in cash values because of The Second Great War, which provoked financial experts to investigate ways of reestablishing harmony in global exchange. His plan of the PPP hypothesis gave a system to understanding how trade rates ought to hypothetically conform to reflect contrasts in cost levels across nations.

Practical Implications in Absolute Purchasing power Parity

While outright PPP gives a hypothetical benchmark to trade rates, its functional ramifications are nuanced. Certifiable factors, for example, transportation costs, duties, portions, and contrasts in buyer inclinations can make variations in costs for indistinguishable products across various business sectors. Besides, the accessibility of information for exact cost level examinations presents huge difficulties.

Limitations of Absolute PPP

One of the significant reactions of outright PPP is its presumption of homogeneity of merchandise. Truly, even apparently indistinguishable items can have varieties in quality, brand discernment, and purchaser inclinations that influence estimating. For example, while a Major Macintosh might be utilized as a benchmark in the Large Macintosh File to delineate PPP, the burger’s cost might differ because of nearby monetary circumstances, work expenses, and request changes. Another impediment is the effect of non-tradable labor and products, which can essentially impact nearby cost levels without straightforwardly influencing the swapping scale.

Observational Proof

Various examinations have tried to test the legitimacy of outright PPP through observational investigation. Some examination has shown that outright PPP holds preferable over the drawn out over temporarily, proposing that while trade rates might stray from the PPP esteem because of transient market vacillations, they will generally merge over the long haul as exchange open doors are taken advantage of. For example, a review inspecting the value levels of buyer products across various nations north of quite a long while found that while momentary deviations were normal, a more steady long haul relationship lined up with the expectations of outright PPP. Be that as it may, the level of union shifted among various nations, impacted by variables, for example, expansion rates, financial solidness, and government strategies.

Job in Swapping scale Assurance

Outright PPP assumes a urgent part in the more extensive setting of conversion standard assurance. While different models, for example, loan cost equality and money related strategy systems, give extra experiences, outright PPP stays a central reference point for financial specialists and policymakers. Understanding the elements of buying power equality can illuminate choices in regards to money related approach, exchange dealings, and speculation procedures.

Conclusion

In rundown, Outright Buying Power Equality fills in as a basic idea in worldwide financial matters, giving a hypothetical structure to understanding conversion scale elements. Regardless of its restrictions and the intricacies of genuine applications, it stays a fundamental device for financial specialists looking to examine and decipher the interconnectedness of worldwide business sectors. As economies proceed to advance and turn out to be more coordinated, the pertinence of outright PPP in illuminating approach and financial technique will continue, making it a fundamental area of study for people in the future of financial specialists and examiners.