Limitations of PPP as an Economic Indicator

Limitations of PPP as an Economic Indicator

Understanding the Limitations of PPP as an Economic Indicator

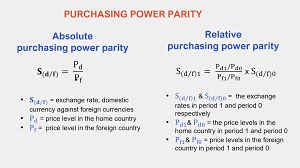

The Limitations of PPP as an Economic Indicator in Purchasing Power Parity (PPP) is a focal idea in worldwide financial matters, generally viewed as an optimal device for looking at the monetary result and typical cost for most everyday items between nations. The PPP hypothesis proposes that in an ideal world, the conversion scale between two monetary standards ought to balance the cost of a decent bushel of labor and products in the two nations. By and by, in any case, PPP as a monetary marker, particularly when utilized in PPP mini-computers, presents a few critical limits. These impediments come from different variables, like market blemishes, contrasts in non-tradable merchandise, social and utilization contrasts, and challenges in information assortment.

Complicated estimation crucial Limitations of PPP

Estimation of purchasing power parity is complicated by the way that nations don’t just vary in a uniform cost level; rather, the distinction in food costs might be more prominent than the distinction in lodging costs, while likewise not exactly the distinction in diversion costs. Individuals in various nations regularly consume various containers of merchandise. It is important to look at the expense of containers of labor and products utilizing a cost record.

This is a troublesome errand since buying examples and, surprisingly, the products accessible to buy vary across nations. Consequently, adapting for contrasts in the nature of labor and products is essential. Besides, the bushel of merchandise illustrative of one economy will shift from that of another: Americans eat more bread; Chinese more rice. Subsequently a PPP determined involving the US utilization as a base will contrast from that determined involving China as a base. Extra measurable troubles emerge with multilateral examinations when (as is typically the situation) multiple nations are to be looked at.

1. Market Flaws and Exchange Expenses critical Limitations of PPP

One of the critical Limitations of PPP is that it expects a universe of wonderful business sectors, where labor and products can be exchanged openly with practically no contact. Actually, notwithstanding, markets are frequently distant from great, and this can contort the PPP computation. Exchange costs, which incorporate transportation charges, levies, charges, and different obstructions to exchange, can fundamentally affect the cost of labor and products in various nations. These expenses forestall the ideal circumstances imagined by PPP hypothesis, implying that the genuine conversion standard between two monetary forms may not line up with the anticipated PPP-based rate.

For instance, think about the worldwide market for agrarian items. While similar harvests might fill in the two India and the US, worldwide exchange limitations, appropriations, or transportation expenses can cause cost errors that keep the costs from balancing in spite of the basic comparability in the expense of the natural substance.

2. Strategic issues (Limitations of PPP)

Notwithstanding strategic issues introduced by the choice of a bin of products, PPP evaluations can likewise fluctuate in view of the measurable limit of taking part nations. The Global Correlation Program (ICP), which PPP gauges depend on, require the disaggregation of public records into creation, consumption or (at times) pay, and not all partaking nations regularly disaggregate their information into such classifications.

A few parts of PPP examination are hypothetically unimaginable or hazy. For instance, there is no reason for correlation between the Ethiopian worker who lives on teff with the Thai worker who lives on rice, since teff isn’t financially accessible in Thailand and rice isn’t in Ethiopia, so the cost of rice in Ethiopia or teff in Thailand not entirely set in stone. When in doubt, the more comparative the cost structure between nations, the more legitimate the PPP correlation.

3. Contrasts in Non-Tradable Labor and products (Limitations of PPP)

PPP number crunchers regularly center around contrasting costs for a container of labor and products that can be exchanged across borders. Notwithstanding, a critical piece of utilization in any economy comprises of non-tradable labor and products. These incorporate things like land, medical services, and training, which are intensely impacted by nearby market interest conditions and are not handily imported or sent out. For example, the cost of lodging in a significant city like New York might be radically not quite the same as the cost of lodging in a more modest town in India, regardless of whether both are evaluated in their particular monetary standards.

4. Handled and Costly items (Limitations of PPP)

More handled and costly items are probably going to be tradable, falling into the subsequent classification, and floating from the PPP conversion scale to the cash conversion scale. Regardless of whether the PPP “esteem” of the Ethiopian cash is multiple times more grounded than the money conversion scale, it won’t buy three fold the amount of universally exchanged products like steel, vehicles and computer chips, however non-exchanged merchandise like lodging, administrations (“hair styles”), and locally created crops. The relative cost differential among tradables and non-tradables from top level salary to low-pay nations is an outcome of the Balassa-Samuelson impact and gives a major expense benefit to work escalated creation of tradable products in low pay nations (like Ethiopia), as against big league salary nations (like Switzerland).

5. Varieties in Nature of Labor and products

One more huge constraint of PPP as a financial pointer lies in the intrinsic contrasts in the nature of labor and products between nations. Contrasts in quality, marking, and shopper inclinations make it challenging to accomplish exact correlations. For instance, a cheap food feast in the US might cost fundamentally more than one in India, however the nature of the dinner, segment sizes, and the eating experience might vary. This disparity can prompt huge contortions in PPP computations, as the supposition of an indistinguishable bin of products is frequently ridiculous. Essentially, buyer products like hardware, dress, and vehicles might shift regarding quality and brand accessibility, further muddling the utilization of PPP as a dependable financial marker.

6. Less expensive laborers

The corporate expense advantage isn’t anything more modern than admittance to less expensive laborers, but since the compensation of those specialists goes farther in low-pay nations than high, the overall compensation differentials (between country) can be supported for longer than would be the case in any case. (This is one more approach to saying that the compensation rate depends on normal neighborhood efficiency and that this is underneath the per capita efficiency that manufacturing plants offering tradable merchandise to global business sectors can accomplish.)

7. Social and Utilization Contrasts

Social elements assume a urgent part in forming utilization examples, and this can subvert the exactness of PPP estimations. Various nations have differing inclinations for labor and products, which influences the sythesis of the container of merchandise utilized in PPP correlations. For instance, while one nation might consume an enormous extent of its pay on extravagance merchandise, another may focus on fundamental necessities. These distinctions imply that the genuine “typical cost for many everyday items” for a typical individual in every nation may not line up with what PPP hypothesis predicts.

Besides, a few nations might spend a lopsided measure of their pay on specific classifications, for example, food or lodging, which are exceptionally factor contingent upon nearby circumstances. These utilization examples can contort correlations of buying power and sabotage the utility of PPP in mirroring the genuine monetary government assistance of people in various nations.

8.Exchange hindrances and nontradables

The law of one cost is debilitated by transport costs and legislative exchange limitations, which make it costly to move merchandise between business sectors situated in various nations. Transport costs cut off the connection between trade rates and the costs of merchandise suggested by the law of one cost. As transport costs increment, the bigger the scope of conversion scale changes. The equivalent is valid for true exchange limitations on the grounds that the traditions expenses influence merchants’ benefits similarly as delivery charges. As per Krugman and Obstfeld, “Either sort of exchange hindrance debilitates the premise of PPP by permitting the buying force of a given cash to contrast all the more broadly from country to country.

They refer to the model that a dollar in London ought to buy similar products as a dollar in Chicago, which is surely not the situation. Nontradables are essentially benefits and the result of the development business. The not entirely settled by homegrown market interest, and changes in those bends lead to changes in the market bushel of a merchandise comparative with the unfamiliar cost of a similar crate. In the event that the costs of nontradables rise, the buying force of some random cash will fall in that country.

9. Information Accessibility and Quality

The precision of PPP estimations is vigorously subject to the accessibility and unwavering quality of information. One of the main difficulties of PPP as a financial pointer is that far reaching and great value information may not be accessible for all nations. Moreover, nations might contrast by they way they report information, making it challenging to make steady cross country examinations. For example, a few nations might remember or prohibit specific labor and products for their public value records, or they might utilize various techniques to compute costs.

What’s more, the most common way of gathering cost information itself can present mistakes. Studies led by global associations like the World Bank or IMF might depend on spot checks or little example estimates that neglect to catch the full variety of costs across areas or segment gatherings. This impediment can decrease the believability of PPP as a device for making exact financial correlations.

10. Takeoffs from free contest

Linkages between public cost levels are likewise debilitated when exchange hindrances and incompletely serious market structures happen together. Estimating to showcase happens when a firm sells similar item at various costs in various business sectors. This is an impression of between country contrasts in conditions on both the interest side (e.g., basically no interest for pork in Islamic states) and the stock side (e.g., whether the current market for an imminent participant’s item includes not many providers or rather is now close soaked). As per Krugman and Obstfeld, this event of item separation and fragmented markets brings about infringement of the law of one cost and outright PPP. After some time, changes in market design and request will happen, which might discredit relative PPP.

11. Swapping scale Unpredictability and Momentary Variances

PPP hypothesis is frequently used to anticipate long haul conversion standard developments, expecting that over the long haul, trade rates will join toward the PPP swapping scale. Be that as it may, temporarily, trade rates can be profoundly unstable, driven by elements like theory, political unsteadiness, and unexpected changes in market feeling. This transient unpredictability can contort the precision of PPP estimations, particularly when utilized as a constant proportion of a cash’s actual worth. For instance, during times of financial emergency or international vulnerability, trade rates might vary altogether, regardless of whether the basic monetary circumstances change.

12. Contrasts in cost level estimation

Estimation of cost levels contrast from one country to another. Expansion information from various nations depend on various item containers; subsequently, swapping scale changes don’t counterbalance official proportions of expansion contrasts. Since it makes forecasts about cost changes instead of cost levels, relative PPP is as yet a helpful idea. Notwithstanding, change in the overall costs of bushel parts can make relative PPP bomb tests that depend on true cost lists.

13. Impact of Government Approaches and Value Controls

Government mediations in the economy, for example, cost controls, appropriations, duties, and charges, can twist market costs and make PPP estimations less dependable. In numerous nations, legislatures carry out cost controls on fundamental products like fuel, food, and lodging with an end goal to decrease expansion or shield shoppers from cost spikes. These mediations can falsely bring down the typical cost for most everyday items in specific districts, making PPP correlations less exact.

In nations with high expansion rates, the public authority may likewise utilize financial approaches, for example, loan cost changes or money mediations to balance out the economy. While these actions might give transient help, they can prompt huge disparities between real market costs and those proposed by PPP-based estimations.

14. Worldwide destitution line

The worldwide destitution line is an overall count of individuals who live under a global neediness line, alluded to as the dollar-a-day line. This line addresses a normal of the public neediness lines of the world’s least fortunate nations, communicated in global dollars. These public neediness lines are switched over completely to worldwide money and the worldwide line is changed back over completely to neighborhood cash utilizing the PPP trade rates from the ICP. PPP trade rates incorporate information from the deals of top of the line non-destitution related things which slants the worth of food things and important products which is 70% of unfortunate people groups’ consumption.

15. Effect of Financial Turn of events and Institutional Contrasts

One more significant Limitations of PPP is its failure to represent contrasts in the degree of financial turn of events and institutional quality between nations. For instance, nations with more fragile foundations or lower levels of monetary advancement might encounter more significant levels of shortcoming, defilement, or regulatory hindrances, which can influence the cost of labor and products. These distinctions in institutional quality can twist PPP-based correlations of financial result and expectations for everyday comforts. In developing business sectors, for instance, the expense of carrying on with work might be higher because of shortcomings in framework, unofficial laws, or admittance to supporting.

16. Changing Examples of Worldwide Exchange

The rising globalization of exchange and the shift toward computerized and administration based economies have additionally confounded the Limitations of PPP as a financial pointer. As worldwide exchange designs develop, the heaviness of various ventures and areas in public economies changes. This shift can prompt lopsided characteristics in the overall costs of labor and products, especially as nations become more coordinated into worldwide stockpile chains or push toward a help situated economy. These areas, which are many times less dependent on actual products, can resist customary cost examinations. Also, the ascent of worldwide online business stages can bring down the expense of specific merchandise in certain nations while making others more costly, further confusing PPP changes.

17. The Requirement for Beneficial Pointers

Given the various restrictions of PPP as a monetary marker, obviously PPP alone is lacking for making precise crosscountry examinations. All things being equal, financial experts and policymakers frequently use PPP related to different pointers, for example, ostensible Gross domestic product, Human Improvement File (HDI), or changed pay measures, to get a more extensive perspective on worldwide monetary circumstances.

By consolidating PPP with these extra markers, it is feasible to acquire a more nuanced comprehension of the genuine financial scene across nations. This all encompassing methodology considers a superior comprehension of expectations for everyday comforts, pay imbalance, and the general personal satisfaction, past what PPP alone can give.

Conclusion

While purchasing power parity (PPP) stays a valuable device for making expansive crosscountry financial examinations, its constraints as a monetary pointer ought not be disregarded. Factors like market blemishes, varieties in non-tradable products, contrasts in quality and utilization designs, information