Application of Purchasing Power Parity in Currency Valuation

Application of Purchasing Power Parity in Currency Valuation

Introduction to the Application of Purchasing Power Parity in Currency Valuation

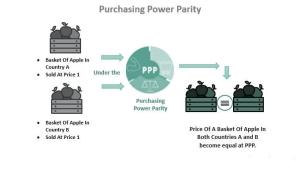

The Application of Purchasing Power Parity (PPP) is a basic monetary hypothesis that places that without transportation expenses and hindrances to exchange, indistinguishable merchandise ought to have a similar cost when communicated in a typical cash. This rule is especially helpful with regards to money valuation, as it gives a system to deciding if a cash is exaggerated or underestimated comparative with another. By contrasting the general value levels of a container of merchandise across various nations, financial experts can evaluate whether the swapping scale between two monetary standards mirrors their actual buying power.

Overview of Application of Purchasing Power Parity in Currency Valuation

The use of PPP in cash valuation starts with the determination of a standard container of labor and products that are illustrative of utilization designs in different nations. The costs of these things are gathered in every nation and changed over into a typical cash, commonly the U.S. dollar. This interaction considers the foundation of a PPP swapping scale, which is the rate at which a cash would should be traded to balance the buying power between the two economies. For instance, in the event that a bin of merchandise costs $100 in the US and a similar crate costs €80 in the Eurozone, the PPP conversion scale would be 1.25 USD/EUR. Assuming the real market conversion standard is not the same as this worth, it might show that one money is mispriced.

One huge utilization of PPP in cash valuation is its capacity to distinguish long haul patterns in return rates. While market trade rates can be impacted by momentary variances because of elements like hypothesis, international occasions, and loan fee changes, PPP gives a more steady and central reason for correlation. This drawn out point of view is fundamental for financial backers and policymakers, as it assists them with settling on informed choices in regards to money speculations, worldwide evaluating procedures, and exchange discussions.

Effect of expansion on Currency valuation

In addition, PPP is especially significant in evaluating the effect of expansion on cash valuation. Various nations experience fluctuating expansion rates, which can twist market trade rates over the long haul. By changing trade rates for expansion utilizing PPP. Financial experts can determine a more exact image of a money’s genuine worth. For example, on the off chance that a nation encounters higher expansion than its exchanging accomplices. Its cash might deteriorate in genuine terms, regardless of whether ostensible trade rates stay stable. This understanding is vital for organizations participated in global exchange, as it assists them with expecting shifts in upper hand and change evaluating in like manner.

In spite of its assets, the use of PPP in cash valuation isn’t without restrictions. Pundits bring up that the choice of the bin of products can fundamentally impact the outcomes, as purchaser inclinations and utilization designs contrast broadly across nations. Besides, transportation expenses, duties, and neighborhood economic situations can keep costs from balancing, consequently confusing the immediate utilization of PPP in genuine situations. In that capacity, while PPP gives a helpful hypothetical structure to understanding cash valuation, it ought to be utilized related to other monetary markers and examinations to shape a far reaching view.

Product comparability by Application of Purchasing Power Parity in Currency Valuation

The hypothesis of buying power equality (PPP), the thought that a dollar ought to purchase similar sum in all nations. Suggests that, in the long term, the swapping scale between two nations ought to move towards the rate that adjusts the costs of an indistinguishable container of labor and products in every country. Notwithstanding, the US, alongside generally created economies, sponsors meat. Bread (which is made of wheat), lettuce,tomato, eggs, potatoes and all homestead items in a Major Macintosh burger. Too, these nations practice protectionism on those items as well as embrace a mercantilist approach in the global market.

Money Worth Component – PPP Procedure

There are a few highlights of cash returns that make money an alluring resource class for institutional financial backers. In any case, the FX market has become well known additionally in the realm of individual financial backers. And hence, concentrating on different variables in this cash world is advantageous. One of these elements is a FX esteem, profoundly associated with a Buying power equality (PPP). A hypothesis concerning the drawn out balance trade rates in view of a general value level of two nations.

The idea referenced above was established on the law of one cost – the possibility that without any exchange costs. Indistinguishable products in various business sectors would be valued something very similar. Nothing unexpected, various nations consume various containers of products; in any case. It is to some extent conceivable to asses an overall cost level. All the more unequivocally, figuring out which nation is “less expensive” and then again. Which nation is “more costly” for living is conceivable.””

Basic explanation

Menkhoff, Sarno, Schmeling, and Schrimpf in “Money Worth” have shown that proportions of cash valuation got from genuine trade rates. Contain critical prescient substance for FX abundance returns and spot conversion scale changes in the cross-segment of monetary standards. The greater part of the consistency referenced above come from constant crosscountry contrasts in macroeconomic basics. This recommends that money esteem for the most part catches risk premia. Which fluctuate across nations yet are somewhat static after some time.

Besides, their outcomes don’t uphold the standard idea that exchanging on straightforward. Proportions of money esteem is beneficial in light of the fact that spot trade rates are returning to central qualities. At the point when the genuine trade rates are deteriorated into fundamental macroeconomic drivers. It was found that refined valuation measures relate all the more near “cash esteem” in the first sense. In that they foresee both overabundance returns as well as an inversion of trade rates.

Conclusion

All in all, the utilization of Buying Power Equality in money valuation is a crucial part of worldwide financial matters. That offers important bits of knowledge into the overall strength of monetary forms. By contrasting value levels of a normalized container of products across various nations. PPP recognizes whether monetary standards are genuinely esteemed, exaggerated, or underestimated. Its job in breaking down long haul conversion scale patterns, evaluating the impacts of expansion. And illuminating venture systems highlights its significance in the worldwide economy. Notwithstanding, market analysts and monetary experts should stay aware of its limits and utilize a complex way to deal with cash valuation. To guarantee more exact evaluations and successful navigation.