Case Studies in PPP Calculator

Case Studies in PPP Calculator

Introduction to Case Studies

The Case Studies in Public-Private Organizations (PPPs) have arisen as an imperative procedure for states all over the planet, planning to outfit the mastery and productivity of the confidential area in the conveyance of public foundation and administrations. From transportation organizations to medical care offices, PPPs empower the pooling of assets, risk-sharing, and advancement, which are fundamental in a period of obliged public spending plans and developing framework requests. In any case, the effective execution of PPP projects relies on exhaustive monetary examination and chance appraisal, making devices like PPP adding machines basic.

Overview

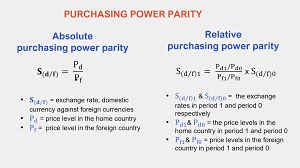

PPP calculators act as hearty scientific structures that help partners in assessing likely undertakings by considering different information factors, for example, project costs, income estimates, funding terms, and chance variables. These mini-computers work with informed independent direction and guarantee that both public and confidential substances have a reasonable comprehension of the monetary ramifications of their organizations. This article digs into explicit contextual analyses that represent the utilization of PPP adding machines, delineating how these apparatuses have been applied in genuine situations, the difficulties confronted, and the examples learned.

Number of Case Studies

Here is the detailed overview of case studies in ppp calculator

Case Study 1: The Sydney Light Rail Undertaking

The Sydney Light Rail project addresses a critical interest in metropolitan vehicle pointed toward decreasing blockage and advancing reasonable versatility in perhaps of Australia’s biggest city. The undertaking was intended to give a cutting edge light rail network associating key objections in Sydney, upgrading public vehicle choices for occupants and vacationers the same. At first, a far reaching monetary investigation was directed utilizing a PPP mini-computer to survey the undertaking’s practicality.

The PPP calculator assumed a vital part in assessing the capital and functional uses related with the task. It permitted partners to assess different supporting situations, including public subsidizing and confidential speculation, while surveying potential income streams from ticket deals and government appropriations. Notwithstanding, the undertaking confronted various difficulties, including local area resistance, unexpected development costs, and administrative obstacles. These variables featured the significance of dynamic displaying inside the PPP adding machine, empowering partners to change their conjectures and survey the effect of evolving conditions.

Eventually, the Sydney Light Rail project prevailed in its objective of giving a cutting edge transportation arrangement, yet it likewise highlighted the intricacies innate in enormous scope PPP drives. The utilization of the PPP number cruncher demonstrated important in exploring these difficulties, exhibiting the requirement for adaptability and responsiveness in project monetary evaluations.

Case Study 2: The UK’s Confidential Money Drive (PFI)

The Confidential Money Drive (PFI) in the Unified Realm is an eminent illustration of a drawn out way to deal with foundation speculation through open confidential organizations. Sent off during the 1990s, the PFI expected to energize private area interest openly benefits, especially in areas like medical care and training. Different tasks inside this structure used PPP number crunchers to assess monetary practicality, risk the board, and long haul supportability.

Explicit contextual analyses, for example, the development of the new medical clinics and schools, represented the viability of PPP number crunchers in surveying complex monetary game plans. Partners had the option to display different subsidizing situations, including public commitments and confidential supporting, while at the same time examining the potential for future income age through assistance contracts.

Be that as it may, the PFI approach has not been without analysis. A few tasks confronted difficulties connected with cost overwhelms, absence of straightforwardness, and public kickback. The examples gained from these contextual investigations accentuated the need for thorough monetary demonstrating and partner commitment to guarantee that PPP game plans live up to public assumptions and convey an incentive for cash.