Effects of inflation on ppp

Effects of inflation on ppp

Pevaluating of labor and products over the long haul is known as expansion. Somewhere in the range of 1914 and 2023, the normal yearly expansion rate overall was around 4.1%. Hence, gentle expansion has been what was going on and a reality for more than hundred years. Along these lines, it’s basic to recognize the impacts of expansion at all rates and those select to times when expansion is unusually high. The above realities make it basic to separate between the understood impacts of expansion at some random point; those effects possibly get uncovered when expansion is strangely high. Effects of inflation on ppp

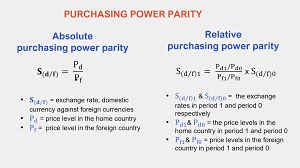

In this way, buying power equality conveys the conversion scale at which one country’s money will get changed over into one more to purchase an indistinguishable measure of a huge scope of items. According to this idea, two monetary forms of two countries are in harmony (at standard) when separate specialists value a bin of products at similar rate in the two nations with due thought of trade rates.

There are many effects of expansion on the economy. Expansion diminishes the buying force of a nation’s money. The decrease in buying power prompts an expansion in the costs of items and administrations. To compute PP utilizing traditional monetary rules, you can look at the cost of an item or administration against a laid out cost record like CPI (Shopper Value File). Effects of inflation on ppp

What Are the Inherent Effects of Inflation?

Expansion suggests an ascent in costs of wares and administrations over a particular period. At the point when there is a cost increment, shoppers perpetually lose buying power. It means the force of a solitary money unit losing its versatility, which it did previously. A minor level of expansion won’t be a ruling component, yet it very well may be when there is a precarious ascent in cost. In any case, you may be interested to understand what elements oversee expansion.

The most common effects of inflation are as follows:

-

Results of expansion might prompt an obvious unevenness popular and supply. Expansion raises when the general interest for products and administrations increments when supplies go down at expected cost levels.

-

Supply boundaries or shocks might drive expansion. You could have heard that worldwide unrefined petroleum costs have taken off because of Russia’s control of Ukraine’s domains. Subsequently, Russia embraced harsh measures by crushing the market considering the assents clasped by the worldwide local area. This huge drop in oil supply achieved an uncommon cost climb.

-

Plus, purchasers are anxious when they anticipate expansion. While representatives working in the general population and confidential areas expect a cost heightening, they request higher compensation to safeguard against potential cost hops. Most assembling businesses answer this changing situation by raising the expense of creation, which has a conclusive effect of expansion on the economy.

The impacts of expansion can be an ethicalness or a bad habit. Everything really relies on how financial policymakers work on them. According to one perspective, national banks and government specialists plan for controllable cost increments by laying out inflationary goals. In like manner, shoppers respond by purchasing labor and products in an unassuming inflationary circumstance. Nonetheless, the entire climate changes when expansion takes a lofty ascent. This unexpected ascent might hurt the buying force of shoppers. At the point when expansion is at its pinnacle, states as a rule raise interest.