Practical Applications of PPP

Practical Applications of PPP

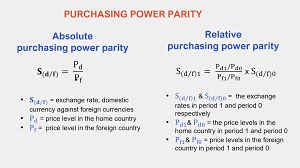

The Practical Applications of PPP financial hypothesis that assumes a critical part in looking at the overall worth of monetary forms and the way of life between various nations. A PPP mini-computer is a device used to apply this idea, permitting clients to adapt to cost level contrasts between countries. This segment investigates the monetary utilizations of PPP adding machines, outlining their commonsense use in worldwide financial examination, global exchange, policymaking, and cross-line business tasks.

Looking at Ways of life Across Nations with respect to Practical Applications of PPP

One of the most crucial purposes of PPP mini-computers is to think about the ways of life between nations. Customary Gross domestic product correlations frequently miss the mark since they depend on trade rates that can vacillate because of variables inconsequential to the cost for many everyday items, like speculative exercises or government intercessions. Conversely, PPP-changed measures give a more precise correlation by representing contrasts in nearby cost levels.

How Practical Applications of PPP Adapts to Expectations for everyday comforts?

A PPP number cruncher looks at the expense of a normalized bushel of products in various nations, like food, dress, transportation, and medical care. The outcome is a proportion of how much pay is expected in every country to accomplish a similar way of life. For instance, while $1,000 could appear as though a lot of cash in an emerging nation, it may not give a similar buying power in a big time salary economy, where the cost for many everyday items is a lot higher.

By Practical Applications of PPP, financial experts can decide:

Genuine pay levels: What individuals can manage with their pay in various nations.

Relative abundance: How rich or poor a country is in contrast with others subsequent to adapting to neighborhood cost varieties.

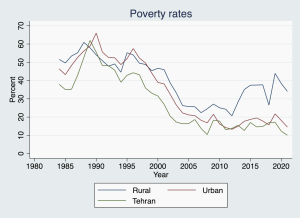

Worldwide destitution rates: Exact estimations of neediness in genuine terms, not simply in ostensible cash values.

For worldwide associations like the World Bank or IMF, PPP-changed pay levels are basic in following worldwide neediness and making crosscountry correlations of financial prosperity.

2. Working out Genuine Gross domestic product

Genuine Gross domestic product (GDP) is a key financial pointer used to gauge the complete result of an economy. While ostensible Gross domestic product is determined utilizing current trade rates, this can frequently be deceiving, particularly while contrasting economies and different expansion rates or cost levels. PPP mini-computers assist with resolving this issue by changing ostensible Gross domestic product for cost level contrasts.

How PPP Changes Gross domestic product:

A PPP-changed Gross domestic product computation gives a more exact image of a country’s truly monetary result, representing varieties in living expenses and expansion. By utilizing PPP to change over Gross domestic product figures, it is feasible to:

Get more precise monetary correlations: This change assists with looking at the general financial strength of countries without the bending made by conversion scale variances.

Reflect genuine result limit: It guarantees that the financial worth isn’t misjudged or underrated dependent exclusively upon the ostensible worth of monetary forms.

Measure genuine development:

For arising economies, PPP-changed Gross domestic product is frequently used to survey whether their financial development is significant comparative with their cost for most everyday items. Practically speaking, nations with lower cost levels (like India or Indonesia) frequently show higher Gross domestic product while estimated utilizing PPP, mirroring their more prominent buying power notwithstanding lower ostensible Gross domestic product.

Utilizations of PPP Mini-computers in Business and Exchange

Buying Power Equality (PPP) adding machines are fundamental devices in the realm of global business and exchange. By adapting to contrasts in cost levels between nations, PPP mini-computers give a more precise impression of the general worth of monetary standards and the buying force of customers across various business sectors. These applications assist organizations with settling on informed conclusions about valuing, market section, store network advancement, and money risk the board.

1. Worldwide Valuing Procedures

One of the most basic utilizations of PPP mini-computers in business is in setting worldwide evaluating systems. For organizations that work in numerous nations, changing item costs as per nearby buying power guarantees that labor and products are evaluated suitably for the objective market. Without utilizing PPP, organizations might overrate or undervalue their items in unfamiliar business sectors because of contrasts in return rates and nearby expense levels.

How PPP Adding machines Help:

Valuing Consistency:

By utilizing PPP, organizations can guarantee that the general costs of products mirror the neighborhood monetary circumstances in each market. This aides in keeping up with valuing consistency across various areas while adapting to nearby pay levels and buying power.

Buyer Moderateness:

PPP mini-computers permit organizations to fit their evaluating techniques to match what neighborhood purchasers can manage, guaranteeing seriousness in each market.

Keeping away from Money Bending:

Trade rates vary continually, however they don’t necessarily mirror the real buying influence of a cash. By utilizing PPP-changed information, organizations can try not to cost twists brought about by impermanent cash unpredictability.

2. Market Passage Choices

PPP adding machines are instrumental in going with market passage choices. At the point when an organization is thinking about venturing into another nation or district, grasping the nearby financial circumstances, including the overall buying force of customers, is pivotal for surveying whether entering another market will be productive.

How PPP Mini-computers Help:

Market Likely Appraisal:

By examining PPP information, organizations can gauge the expected size of the market. Nations with high buying power are probably going to offer better open doors for premium or extravagance merchandise, while those with lower buying power might be more appropriate for financial plan or worth arranged items.

Grasping Neighborhood Financial Circumstances:

A high ostensible conversion standard doesn’t be guaranteed to mean areas of strength for an economy. PPP-changed estimations give bits of knowledge into the genuine financial strength of a market by adapting to neighborhood cost varieties. This assists organizations with trying not to misconceive the market in light of ostensible trade rates alone.

Upper hand:

By understanding the value awarenesses of nearby purchasers, organizations can adjust their item contributions and estimating procedures to satisfy market need. For instance, an organization considering entering a market with a generally lower PPP could change its item situating or present a more practical variant of its item.

PPP Adding machines in Financial Arrangement by Practical Applications of PPP

Buying Power Equality (PPP) number crunchers assume a significant part in the detailing and examination of financial strategy at both the public and global levels. By adapting to cost level contrasts between nations, PPP number crunchers furnish policymakers with a more clear comprehension of the general worth of monetary forms and the financial states of various countries. This empowers legislatures, national banks, and global associations to settle on educated choices on an assortment regarding key financial issues, going from conversion scale strategy and expansion focusing to monetary preparation and destitution mitigation.

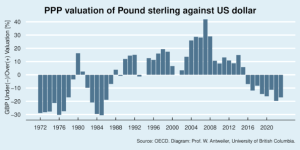

1. Conversion scale Strategy

Swapping scale strategy is one of the focal devices accessible to legislatures and national banks for dealing with their economies. The objective of swapping scale strategy is frequently to settle the money, control expansion, or improve send out intensity. PPP mini-computers are utilized to assess whether a cash is exaggerated or underestimated comparative with different monetary standards, which is a basic thought while setting conversion scale strategies.

How PPP Adding machines Help:

Distinguishing Money Misalignments:

PPP mini-computers assist policymakers with recognizing whether the ostensible swapping scale of their cash mirrors its actual buying influence. On the off chance that a money is exaggerated or underestimated by PPP, it might demonstrate that the swapping scale doesn’t precisely address the fundamental financial circumstances, prompting irregular characteristics in exchange or capital streams.

Directing Conversion scale Changes:

By giving a gauge to what trade rates ought to be, PPP number crunchers can direct national banks and legislatures in making acclimations to balance out the cash. On the off chance that a country’s money is underestimated, it might provoke policymakers to permit the cash to appreciate, or make moves to forestall inordinate devaluation.

Supporting Fixed versus Drifting Conversion scale Frameworks:

In nations with a fixed or fixed conversion scale framework, PPP can be utilized to evaluate whether the fixed swapping scale is supportable over the long haul. A huge deviation from PPP might prompt a reexamination of the fixed rate to stay away from expected emergencies.

2. Financial Arrangement and Expansion Focusing on with Practical Applications of PPP

Financial arrangement is another basic region where PPP estimations are helpful. National banks depend on money related strategy apparatuses, for example, loan fees, to impact expansion and balance out the economy. PPP-changed trade rates help in understanding how expansion rates and the genuine worth of a money connect in a globalized economy. By integrating PPP into their arrangement systems, national banks can all the more likely oversee expansion and keep away from the distortionary impacts of swapping scale variances.

How PPP Adding machines Help:

Expansion Differentials:

PPP gives an obvious sign of the expansion differential between nations. On the off chance that one nation is encountering higher expansion than its exchanging accomplices, PPP can show how this will disintegrate the cash’s buying control after some time, prompting changes in return rates. National banks can then utilize this data to expect inflationary patterns and change loan fees likewise.

Focusing on Genuine Trade Rates:

National banks can utilize PPP to set long haul focuses for genuine trade rates. By holding back nothing swapping scale that lines up with the PPP rate, policymakers can assist with keeping a stable monetary climate, empowering speculation and diminishing instability.

Strategy Coordination:

PPP likewise works with strategy coordination between nations. At the point when nations have comparative degrees of expansion or financial circumstances, PPP computations can assist with adjusting money related approach and swapping scale changes, forestalling undesirable awkward nature. In nations with out of control inflation or stagflation, for example, Venezuela or Zimbabwe, PPP-changed measures are basic for grasping the genuine degree of expansion and pursuing informed strategy choices.

The genuine pace of return and the buying influence of money

Genuine Rate Genuine Pace of Return

Capital disintegration is the deficiency of worth of a resource or speculation after some time because of expansion, expenses, charges, or different elements. It can diminish the genuine pay and abundance of people and organizations, and influence their drawn out monetary objectives. To quantify the degree of capital disintegration, we really want to think about two significant ideas: the genuine pace of return and the buying influence of cash. These ideas assist us with assessing how much our cash can purchase from here on out, and the amount we want to contribute to keep up with or increment our buying power.

Worth of a speculation by Practical Applications of PPP

The genuine pace of return is the rate increment or diminishing in the worth of a speculation in the wake of adapting to expansion. It mirrors the genuine procuring capability of a venture, and the amount it can develop or contract in genuine terms. For instance, in the event that a speculation procures an ostensible pace of return of 10% in a year, and the expansion rate is 3%, then the genuine pace of return is 10% – 3% = 7%. This implies that the speculation has expanded its worth by 7% in genuine terms, subsequent to representing the deficiency of buying power because of expansion.

Buying influence in Practical Applications of PPP

The buying influence of cash is how much labor and products that a unit of cash can purchase at a given moment. It is conversely connected with the cost level, which is the normal of costs of labor and products in an economy. As the cost level ascents, the buying influence of cash falls, as well as the other way around. For instance, on the off chance that the cost of a portion of bread is $1 today, and $1.05 tomorrow, then the buying force of $1 has fallen by 5%. This implies that $1 can purchase less bread tomorrow than today.

To quantify the effect of capital disintegration on the buying influence of cash, we want to think about the accompanying variables:

1. The underlying measure of cash or venture.

This is the beginning stage of our examination, and it addresses the worth of our cash or venture at a given moment.

2. The ostensible pace of return or loan fee.

This is the rate change in the worth of our cash or venture throughout some undefined time frame, without adapting to expansion. It very well may be positive or negative, contingent upon whether our cash or speculation develops or recoils in ostensible terms.

3. The expansion rate.

This is the rate change in the cost level throughout some stretch of time, and it mirrors the deficiency of buying influence of cash because of rising costs. It can likewise be positive or negative, contingent upon whether the cost level ascents or falls.

4. The genuine pace of return or loan cost.

This is the rate change in the worth of our cash or venture throughout some undefined time frame, in the wake of adapting to expansion additionally. It tends to be determined by taking away the expansion rate from the ostensible pace of return or loan fee, as made sense of above additionally. It mirrors the genuine bringing in capability of our cash or speculation, and the amount it can develop or recoil in genuine terms additionally.

5. The future worth of cash or speculation.

This is the worth of our cash or speculation at a future moment, additionally in the wake of applying the ostensible or genuine pace of return or loan fee throughout some undefined time frame. It addresses how much labor and products that our cash or speculation can purchase from now on additionally.

Monetary Approach and Financial Development by the Practical Applications of PPP

PPP adding machines are additionally fundamental devices for figuring out powerful financial strategies, which include government spending, tax assessment, and acquiring. By adapting to cost level contrasts between nations, PPP information gives a more precise proportion of a country’s genuine Gross domestic product, assisting states with surveying their generally speaking financial exhibition and figure out suitable monetary measures.

How PPP Adding machines Help:

Estimating Truly Financial Result:

Monetary strategy choices frequently depend on Gross domestic product information to distribute assets, change charge rates, and decide spending needs. PPP-changed Gross domestic product gives a more precise impression of a country’s monetary result by adapting to cost contrasts. This is particularly significant for emerging nations, where ostensible Gross domestic product might be misdirecting because of lower cost levels.

Evaluating Financial Turn of events:

States use PPP-changed measures to follow long haul monetary turn of events and guarantee that monetary arrangement is coordinated toward practical development. By looking at genuine Gross domestic product development rates across nations, policymakers can recognize the best monetary measures that advance fair development.

Obligation The board:

While overseeing public obligation, PPP adding machines assist legislatures with surveying the genuine weight of obligation, especially according to the buying force of their residents. In the event that a country’s ostensible Gross domestic product is developing however its PPP-changed Gross domestic product is stale, it could flag a basic issue with financial efficiency and development, impacting obligation the executives techniques additionally. PPP information assists states with guaranteeing that their monetary arrangements are receptive to the genuine financial states of their populace, empowering better choices on tax collection and government spending additionally.

4. Neediness Line Changes and Social Approach by Practical Applications of PPP

One of the main uses of PPP in financial approach is in the estimation and change of destitution lines. Numerous worldwide associations, including the World Bank, use PPP-changed destitution lines to precisely gauge worldwide neediness more. Since the typical cost for many everyday items changes broadly across nations, PPP gives a more dependable measurement to surveying the degree of destitution on a worldwide scale.

How PPP Adding machines Help:

Setting a Worldwide Neediness Line:

The World Bank’s destitution line, set at $1.90 each day, depends on PPP changes in accordance with represent the different cost levels between nations. This guarantees that the destitution line mirrors the genuine buying force of people in various economies, as opposed to simply changing over dollar figures utilizing trade rates that may not precisely reflect nearby circumstances.

Evaluating Disparity:

PPP takes into consideration better correlations of pay imbalance between countries. In certain nations, a low ostensible pay might in any case give significant buying power, while in others, a higher ostensible pay might have less buying power because of more exorbitant costs. By adapting to these incongruities, PPP assists policymakers with planning more viable destitution easing programs additionally.

Checking Destitution Decrease Progress:

Additionally state run administrations and worldwide organizations use PPP-changed neediness lines to follow the outcome of hostile to neediness drives.