Problems and Extensions of PPP

Problems and Extensions of PPP

The principal issue with the buying power equality (PPP) hypothesis is that the PPP condition is seldom fulfilled inside a country. There are many reasons that can make sense of this thus, given the rationale of the hypothesis, which appears to be legit, financial specialists have been hesitant to dispose of the hypothesis based on absence of supporting proof. Beneath we think about a portion of the reasons PPP may not hold. Problems and Extensions of PPP.

Problems with the PPP Theory for Problems and Extensions of PPP

Transportation expenses and exchange limitations. Since the PPP hypothesis gotten from the law of one value, similar suppositions are required for the two speculations. The law of one cost expects that there are no transportation costs and no differential duties applied between the two business sectors. These intend that there can be no levies on imports or different sorts of limitations on exchange. Since transport expenses and exchange limitations truly do exist this present reality, this would will quite often drive costs for comparative merchandise separated.

Transport expenses ought to make a decent less expensive in the sending out market and more costly in the bringing in market. Likewise, an import duty would split apart the costs of an indistinguishable decent in two exchanging nations’ business sectors, bringing it up in the import market comparative with the commodity market cost. Accordingly the more prominent transportation expenses and exchange limitations are between nations, the more uncertain for the expenses of market crates to be balanced.

Expenses of nontradable information sources for Problems and Extensions of PPP

Expenses of nontradable information sources. Numerous things that are homogeneous by and by sell at various costs since they require a nontradable contribution to the creation interaction. For instance, consider the reason why the cost of a McDonald’s Huge Macintosh cheeseburger sold in midtown New York City is higher than the cost of similar item in the New York rural areas. Since the lease for eatery space is a lot higher in the downtown area, the café will pass along its greater expenses as more exorbitant costs. Substitute items in the downtown area (other drive-thru eateries) will confront similar high rental expenses and in this way will charge more exorbitant costs also. Since it would be unreasonable (i.e., exorbitant) to create the burgers at a less expensive rural area and afterward transport them available to be purchased in the city, rivalry wouldn’t drive the costs together in the two areas.

Business sectors for Problems and Extensions of PPP

Wonderful data. The law of one cost accepts that people have great, even awesome, data about the costs of merchandise in different business sectors. Just with this information will benefit searchers start to trade products to the excessive cost market and import merchandise from the low-valued market. Consider a case where there is defective data. Maybe some value deviations known to merchants yet different deviations are not known, or perhaps just a little gathering of dealers familiar a value inconsistency and that gathering can’t accomplish the size of exchange expected to level the costs for that item.

(Maybe they face capital limitations and can’t acquire sufficient cash to fund the size of exchange expected to balance costs.) regardless, brokers without data about value contrasts won’t answer the benefit amazing open doors and hence costs won’t adjusted. In this manner the law of one cost may not hold for certain items, which would suggest that PPP wouldn’t hold by the same token.

Other market for Problems and Extensions of PPP

Other market members. Notice that in the PPP harmony stories, it is the way of behaving of benefit looking for merchants and exporters that powers the conversion scale to change in accordance with the PPP level. These exercises would recorded on the ongoing record of a nation’s equilibrium of installments. Subsequently it is sensible to say that the PPP hypothesis depends on current record exchanges. This differences with the loan fee equality hypothesis in which the way of behaving of financial backers looking for the most elevated paces of profit from ventures rouses changes in the conversion scale. Since financial backers are exchanging resources, these exchanges would show up on a country’s capital record of its equilibrium of installments. In this manner the loan fee equality hypothesis depends on capital record exchanges.

Money trade

It assessed that there around $1-2 trillion bucks worth of money traded consistently on global unfamiliar trade (Forex) markets. That is one-eighth of U.S. Gross domestic product, which is the worth of creation in the US in a whole year. Also, the $1-2 trillion gauge made by counting just a single side of every money exchange. Consequently that is a gigantic measure of exchange. On the off chance that one considers the aggregate sum of world exchange every year and, partitions by 365, one can get the typical measure of labor and products exchanged day to day.

This number is under $100 billion bucks. This implies that how much everyday cash exchanges is in excess of multiple times how much day to day exchange. This reality would strongly imply that the essential impact on the everyday conversion scale should brought about by the activities of financial backers as opposed to shippers and exporters. In this manner the cooperation of different merchants in the Forex market, who propelled by different worries, may lead the swapping scale to a worth that isn’t predictable with PPP.

Relative PPP

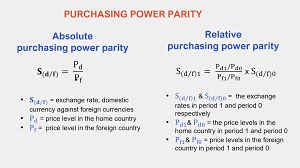

There an elective form of the PPP hypothesis called the “relative PPP hypothesis.” basically this a unique rendition of the outright PPP hypothesis. Since outright PPP recommends that the swapping scale might answer expansion, we can envision that the conversion standard would change in an efficient manner given that a constant change in the cost level (expansion) is happening.

In the general PPP hypothesis, conversion standard changes over the long run thought to be reliant upon expansion rate differentials between nations as per the accompanying recipe:

Ep/$2−Ep/$1Ep/$1=πp−π$.

Here the rate change in the dollar esteem between the primary period and the subsequent period given on the left side. The right side gives the distinctions in the expansion rates among Mexico and the US that assessed throughout a similar time span. The ramifications of relative PPP is that assuming the Mexican expansion rate surpasses the U.S. expansion rate, then the dollar will appreciate by that differential over a similar period. The rationale of this hypothesis is equivalent to in outright PPP. All things considered. In the event that costs keep on rising quicker in Mexico than in the US, for instance, cost contrasts between the two nations would develop and the best way to stay aware of PPP is for the dollar to appreciate consistently versus the peso.