Purchasing power parities

Purchasing power parities

Introduction

A buying power equality (PPP) transformation factor is a spatial value deflator and cash converter that controls for cost level contrasts between nations, subsequently permitting volume correlations of GDP (Gross domestic product) and its consumption parts. The transformation factor introduced on ILOSTAT is for family last utilization use. It applied to profit and work expenses to switch public figures in public cash over completely to a typical money.Purchasing power parities

Concepts and definitions

PPPs are both money change factors and spatial cost files. PPPs convert various monetary forms to a typical cash and, during the time spent change, balance their buying power by controlling contrasts in cost levels between nations. Ordinarily, higher pay nations have greater cost levels, while lower pay nations have lower cost levels (Balassa-Samuelson impact). Market swapping scale based crosscountry examinations of Gross domestic product at its use parts reflect the two distinctions in financial results (volumes) and costs. Given the distinctions in cost levels, the size of higher pay nations is swelled, while the size of lower pay nations is discouraged in the examination. PPP-based crosscountry correlations of Gross domestic product at its consumption parts just reflect contrasts in financial results (volume), as PPPs control for cost level contrasts between the nations. Thus, the correlation mirrors the genuine size of the nations.

Data sources for Purchasing power parities

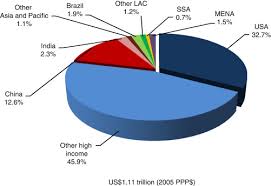

The Global Examination Program (ICP) of the World Bank gauges PPPs for the world’s nations. The ICP directed as a worldwide organization of nations, multilateral organizations, and the scholarly community. The latest 2021 ICP examination covered 176 nations, including 47 Eurostat-OECD nations. For nations that poor person took part in ICP correlations, the PPPs are credited in light of a relapse model.

Interpretation and uses for Purchasing power parities

PPP can utilized to change over public records information, similar to Gross domestic product and its use parts, into a typical money, while likewise disposing of the impact of cost level contrasts between nations. They can likewise utilized to infer cost level records (PLIs), the proportion of a country’s PPP to its market swapping scale, to straightforwardly look at cost levels across nations. PPPs and the PLIs and genuine (or PPP-changed) uses to which they give rise take into account many use-cases, however they are especially important for experimental work including correlations of per capita utilization or levels of Gross domestic product (or other Gross domestic product totals) across nations and for the estimation of worldwide neediness and worldwide pay disparity.

The expansiveness and profundity of ICP information permits its utilization cases to cover different areas of financial matters, including experimental investigations of monetary development, efficiency and exchange, and even past, for example, to assist with following worldwide targets, for example, the UN Supportable Advancement Objectives connected with wellbeing, schooling, energy and emanations and work. Different utilizations of ICP information remember their utilization for the development of records, for instance typical cost for most everyday items measures. Utilizes cases might actually reached out into the policymaking area at all levels (worldwide, provincial and public) given the expanded significance of crosscountry benchmarking, among different potential outcomes.

Recommended uses of PPPs include:

- To make spatial correlations of Gross domestic product and its use parts,

- To make spatial correlations of cost levels, and

- To bunch nations by their per capita volume records and cost level files.

Suggested utilizations of PPPs with impediments include:

- To break down changes after some time in relative Gross domestic product per capita and relative costs,

- To break down cost combination,

- To make spatial correlations of the average cost for most everyday items, and

- To utilize PPPs determined for Gross domestic product and its consumption parts as deflators for different qualities.

Limitations

Worldwide PPP gauges given by ICP are delivered by the ICP Worldwide Office and local carrying out organizations, in view of information provided by taking part nations, and as per the system suggested by the ICP Specialized Warning Gathering and supported by the ICP Administering Board. Thusly, these outcomes are not created by taking an interest nations as a component of their public authority insights.

PPPs not suggested for use:

- As an exact measure to lay out severe rankings of nations,

- For of building public development rates,

- As an action to create result and efficiency examinations by industry, as a mark of the undervaluation or overvaluation of monetary forms, or

- As a harmony conversion standard.

Exchange rates

Introduction

The authority swapping scale alludes to the not entirely settled by public specialists or to still up in the air in the lawfully authorized trade market. It determined as a yearly normal in view of month to month midpoints (nearby money units comparative with the U.S. dollar).

Concepts and definitions

The swapping scale is the cost of one cash as far as another. Official trade rates and swapping scale game plans laid out by state run administrations. Other trade rates perceived by states incorporate market rates, which are resolved generally by lawful market influences, and for nations with various trade game plans, chief rates, optional rates, and tertiary rates.

Data sources

Trade rates from Global Monetary Measurements (Uncertainties) data set of the Worldwide Financial Asset (IMF).

Interpretation and uses

In a market-based economy, family, maker, and government decisions about asset designation impacted by relative costs, including the genuine swapping scale, genuine wages, genuine loan fees, and different costs in the economy. Relative costs likewise generally mirror these specialists’ decisions. Consequently relative costs pass on fundamental data about the collaboration of financial specialists in an economy and with the remainder of the world.

Limitations

Official or market trade rates are much of the time used to change financial measurements in nearby monetary forms over completely to a typical money to make examinations across nations. Since market rates reflect, best case scenario, the general costs of tradable products, the volume of labor and products that a U.S. dollar purchases in the US may not compare to what a U.S. dollar changed over completely to one more country’s cash at the authority conversion scale would purchase in that country, especially when nontradable labor and products represent a huge portion of a nation’s result. An elective swapping scale – the PPP change factor – favored on the grounds that it reflects contrasts in cost levels for both tradable and nontradable labor and products and in this way gives a more significant examination of genuine result.

Hi, this is a comment.

To get started with moderating, editing, and deleting comments, please visit the Comments screen in the dashboard.

Commenter avatars come from Gravatar.