Relative Purchasing Power Parity

Relative Purchasing Power Parity

Relative Purchasing Power Parity: A Comprehensive Overview

The Relative Purchasing Power Parity (RPPP) is a fundamental idea in global financial aspects, offering bits of knowledge into how cash values vacillate in view of expansion differentials between nations. At its center, RPPP sets that the progressions in return rates over the long haul will mirror the distinctions in expansion rates between two nations. Not at all like its partner, outright Buying Power Equality (PPP), which centers around the possibility that indistinguishable merchandise ought to cost similar across various nations, RPPP perceives that costs and money values are dynamic and impacted by different monetary elements over the long run. This article dives into the hypothetical groundworks of RPPP, its useful ramifications, experimental proof supporting its legitimacy, challenges looked in its application, and future contemplations in a quickly changing worldwide monetary scene.

Understanding the Relative Purchasing Power Parity

To understand Relative Purchasing Power Parity, we should initially investigate the verifiable setting and hypothetical underpinnings of the more extensive PPP idea. The beginnings of PPP follow back to the mid nineteenth hundred years, when financial specialists like David Hume started to frame the connection between exchange adjusts and money values. Hume’s thoughts laid the foundation for the advancement of the cost specie stream component, which made sense of what worldwide exchange means for cash values through the development of gold and other valuable metals.

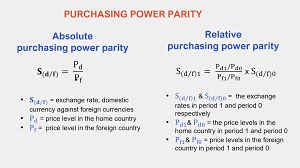

Mechanics of Relative Purchasing Power Parity

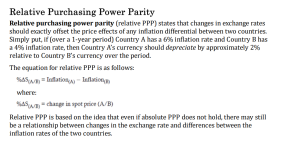

Understanding the mechanics of RPPP requires a nearer assessment of expansion and its effect on trade rates. Expansion, the rate at which the general degree of costs for labor and products rises, dissolves buying power. At the point when one nation has a higher expansion rate contrasted with another, it demonstrates that costs in that nation are expanding all the more quickly. Accordingly, the money of the greater expansion nation is supposed to lose esteem after some time in contrast with the cash of the lower-expansion country. This relationship features the crucial standard of RPPP: trade rates are not static; they are impacted by the overall buying force of monetary forms, which is straightforwardly attached to expansion patterns.

Assumptions in Relative Purchasing Power Parity

Moreover, assumptions assume a critical part in the utilization of RPPP. Market members — dealers, financial backers, and policymakers — structure assumptions in view of current monetary pointers, including expansion rates. Assuming dealers guess that a nation will confront higher expansion later on, they may prudently sell that nation’s money, prompting a quick deterioration. This conduct can make transient variances in return rates, even before expansion differentials completely appear, representing how market brain science entwines with financial essentials.

Observational examinations

Observational examinations on RPPP frequently utilize time-series investigation to assess verifiable information on trade rates and expansion rates across different nations. Specialists search for proof that adjustments of trade rates line up with contrasts in expansion rates over the long haul. While many examinations offer help for RPPP, discoveries can change broadly founded on the chose time span, nations included, and the techniques utilized. A few specialists have found that RPPP holds all the more powerfully throughout longer time spans, as momentary instability and outer shocks can misshape the connection among expansion and trade rates.

Relative Purchasing Power Parity Financial Aspects

Conduct financial aspects additionally reveals insight into the impediments of RPPP. Financial backer brain science, market opinion, and group conduct can drive trade rates from the hypothetical forecasts of RPPP. Indeed, even without a trace of expansion differentials, monetary standards might appreciate or devalue in view of theoretical action or international turns of events, making it trying to depend entirely on RPPP for determining cash developments. Looking forward, the fate of RPPP will probably be formed by a few elements, including mechanical progressions, changes in worldwide financial power, and arising patterns in maintainability.

Rise of new monetary powers

Moreover, the rise of new monetary powers, especially in Asia and Africa, is reshaping the worldwide financial scene. As these nations experience remarkable expansion elements and cash variances, RPPP should adjust to mirror these progressions in a multipolar world economy. Understanding how expansion and trade rates associate in these assorted settings will be vital for policymakers and financial backers the same.

Maintainability

Maintainability is another basic thought impacting cash valuation and expansion rates. As countries wrestle with natural worries, financial arrangements pointed toward tending to supportability could have sweeping consequences for expansion. For example, nations putting vigorously in green advances might encounter unexpected inflationary tensions in comparison to those depending on conventional businesses. RPPP might have to consolidate these arising financial ideal models to stay significant in an undeniably complicated worldwide economy.

Conclusion

All in all, Relative Buying Power Equality gives a significant structure to understanding the many-sided connection among expansion and trade rates. While exact proof backings the idea, certifiable difficulties and market defects can muddle its viable application. As the worldwide economy keeps on developing, the standards of RPPP will stay basic for deciphering money developments and pursuing informed financial choices. The exchange of mechanical headways, international movements, and supportability will shape the fate of RPPP, guaranteeing its pertinence in a unique financial scene.