The Big Mac Index

The Big Mac Index

History of The Big Mac Index

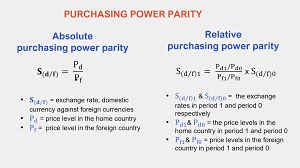

The The Big Mac Index was created by The Financial expert in 1986 as a carefree manual for whether monetary standards are at their “right” level. It depends on the hypothesis of buying power equality (PPP), the thought that over the long haul trade rates ought to move towards the rate that would level the costs of an indistinguishable crate of labor and products (for this situation, a burger) in any two nations. Burgernomics was never planned as an exact measure of cash misalignment, just an instrument to make conversion scale hypothesis more edible. However the Huge Macintosh list has turned into a worldwide norm, remembered for a few financial reading material and the subject of many scholastic investigations. For the people who view their cheap food more in a serious way, we likewise compute a connoisseur variant of the record.

Overview of The Big Mac Index

The hypothesis supporting the Enormous Macintosh record originates from the idea of PPP. Which expresses that the conversion scale between two monetary standards ought to adjust the costs charged for an indistinguishable bushel of merchandise. Be that as it may, as a general rule. Obtaining an indistinguishable bushel of merchandise in each nation gives a mind boggling challenge. As per the Association for Monetary Co-activity and Improvement (OECD), north of “3,000 purchaser labor and products. 30 occupations in government, 200 kinds of hardware merchandise and around 15 development projects” are remembered for the ongoing PPP estimations.

With an end goal to improve on this significant monetary idea. The Financial expert recommended that a solitary McDonald’s Huge Macintosh could be utilized rather than a bin of merchandise. A McDonald’s Huge Macintosh was picked in light of the commonness of the cheap food chain around the world. And on the grounds that the sandwich remains to a great extent the equivalent across all nations. Albeit a solitary sandwich might appear to be excessively shortsighted for PPP hypothesis. The cost of a Major Macintosh is gotten from the finish of “numerous nearby monetary variables. Like the cost of the fixings, neighborhood wages, or the amount it expenses to set up boards and purchase television promotions”. Subsequently, the Large Macintosh record gives a “sensible proportion of true buying power”.

How the The Big Mac Index Functions in a PPP Mini-computer?

The The Big Mac Index gives a method for computing PPP-changed trade rates by looking at the nearby cost of a Major Macintosh to its cost in the US (or another reference country). This is the way you can involve it in a PPP mini-computer:

Recognize the Neighborhood Value:

The cost of a Major Macintosh in the nearby money of a nation is distinguished. For instance, the cost of a Major Macintosh in the UK may be £3.50, while in the US, it very well may be $5.00.

Find the Conversion standard:

You really want the genuine market swapping scale between the two monetary forms. For example, on the off chance that 1 USD rises to 0.75 GBP, the market swapping scale is 0.75.

Work out the Suggested PPP Conversion standard:

This is the swapping scale that would level the cost of a Major Macintosh in every country. You can compute it by separating the nearby cost by the cost in the reference country (generally the US cost of the Large Macintosh).

Suggested PPP Conversion scale=Cost of Large Macintosh in Neighborhood Cash/Cost of Large Macintosh in USD

Suggested PPP Trade Rate=Cost of Large Macintosh in USD/Cost of Large Macintosh in Neighborhood Money

Model

In the event that a Major Macintosh costs £3.50 in the UK and $5.00 in the US:

Suggested PPP Conversion scale=3.505.00=0.70GBP/USD

Suggested PPP Trade Rate=5.003.50=0.70GBP/USD

This implies, under PPP, 1 USD ought to be equivalent to 0.70 GBP at the Large Macintosh costs to be similar in the two nations. Contrast the Genuine Swapping scale with the Suggested PPP Rate: The subsequent stage is to contrast the market conversion standard and the inferred PPP swapping scale to check whether a money is underestimated or exaggerated comparative with the other. On the off chance that the real swapping scale is more grounded than the suggested PPP rate, the unfamiliar cash is exaggerated (i.e., the nearby Huge Macintosh is more costly than it ought to be). Assuming the real conversion standard is more vulnerable than the suggested PPP rate, the unfamiliar cash is underestimated (i.e., the nearby Enormous Macintosh is less expensive than it ought to be).

Model: Assuming that the market swapping scale is 0.75 GBP/USD (i.e., 1 USD = 0.75 GBP), and the suggested PPP conversion standard is 0.70 GBP/USD, then the English pound is exaggerated on the grounds that the Huge Macintosh is more costly than it would be in the US, as per PPP.

Purpose of The Big Mac Index

The purpose behind the The Big Mac Index is to compute an inferred conversion scale between two monetary forms. To work out the Enormous Macintosh list, the cost of a Major Macintosh in a far off country (in the far off nation’s money) is partitioned by the cost of Huge Macintosh in a base country (in the base nation’s cash). Ordinarily, the base nation utilized is the US.

For instance, utilizing figures from July 2023:

- In Switzerland, a Major Macintosh costs 6.70 Swiss francs.

- In the U.S., a Major Macintosh costs US$5.58.

- The inferred swapping scale is 1.20 francs per dollar, that is 6.70 francs/$5.58 = 1.20.

Steady with PPP monetary hypothesis, the Large Macintosh file likewise gives a strategy. To break down a money’s degree of under/over-valuation against a base currency. To compute whether a cash is under/over-esteemed. The suggested swapping scale (as characterized by the Huge Macintosh record) should be contrasted with the genuine conversion standard. On the off chance that the suggested conversion scale is more noteworthy than the real conversion scale. The examined cash is exaggerated against the base money. On the off chance that the suggested conversion scale is not exactly the real conversion scale. The investigated cash is underestimated against the base money.

Restrictions

Non-exchanged products:

The Huge Macintosh isn’t simply an exchanged decent in light of the fact. That its cost incorporates the expense of neighborhood work, lease. And different administrations that don’t enter worldwide exchange.

Different variables:

Contrasts in assessments, levies. Or the expense of data sources (like land, wages, and neighborhood rivalry) can prompt contrasts in costs that don’t be guaranteed to reflect PPP.

Market elements:

The Enormous Macintosh File is a depiction of cost inconsistencies at a particular time. Yet trade rates vacillate persistently because of more extensive market influences.

Do Changes in the The Big Mac Index Demonstrate Expansion?

The expenses of natural substances, work, transportation, duties, and others are estimated into Huge Macintoshes. So any reasonable person would agree that the cost of a Major Macintosh can reflect inflationary tensions. Financial experts consider the shopper cost file the most reliable method for following expansion.

Practical uses

Cash Valuation:

Financial experts and investigators utilize the Large Macintosh Record to follow whether a money is exaggerated or underestimated. On the off chance that a country’s cash is exaggerated by the file. It could flag that labor and products in that nation are more costly contrasted with different nations. Which could influence exchange adjusts.

Contrasting Cost for most everyday items:

The file can likewise give a harsh thought of the general cost for many everyday items between nations. A less expensive Huge Macintosh could show that labor and products. As a general rule, are more affordable in that country.

Conclusion

The The Big Mac Index is an open method for utilizing the standards of Buying Power Equality. To evaluate money values and cost for most everyday items contrasts across nations. While it has impediments, it stays a successful device for. Outlining disparities between market trade rates and the hypothetical trade rates anticipated by PPP. It assists individuals with understanding money misalignments and offers a cheerful. Yet enlightening, method for investigating worldwide financial matters.