Theories in PPP Calculator

Theories in PPP Calculator

Theories in PPP Calculator: An In-Depth Analysis

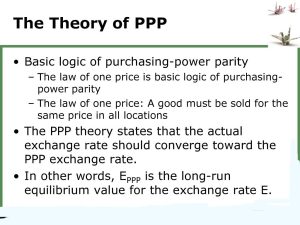

The explanation of Theories in Purchasing Power Parity (PPP) is an essential idea in global financial matters that gives a structure to contrasting the general worth of monetary standards in view of their buying power. The fundamental thought is that without transportation expenses and hindrances to exchange, indistinguishable merchandise ought to have a similar cost when communicated in a typical cash. This rule assists financial analysts with understanding trade rates, expansion, and the by and large monetary soundness of various nations. In the domain of PPP number crunchers, two essential theories rule the talk: Absolute PPP and Relative PPP.

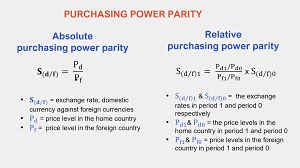

Absolute PPP

Absolute PPP places that the swapping scale between two monetary forms ought to be equivalent to the proportion of the value levels of a proper bin of labor and products in every country. This hypothesis is direct: on the off chance that a container of products costs $100 in the U.S. also, a similar bushel costs €80 in the Eurozone, the normal swapping scale ought to be 1.25 USD/EUR. Outright PPP accepts that the market is proficient, implying that all products are indistinguishable, and there are no extra expenses or boundaries influencing costs. Nonetheless, this present reality frequently veers off from this admired situation. Factors, for example, transportation expenses, taxes, and neighborhood economic situations can prompt disparities in costs that don’t adjust impeccably with trade rates.

Relative PPP

Relative PPP, then again, brings the idea of expansion into the investigation. In the event that one nation encounters a higher expansion rate than another, its money ought to devalue comparative with the other cash. For instance, if the U.S. has an expansion pace of 3% while the Eurozone’s expansion rate is 1%, Relative PPP predicts that the dollar will lose esteem contrasted with the euro over the long haul. This hypothesis is especially valuable for seeing long haul patterns in return rates, as it represents the unique idea of economies.

Useful Representation of Theories

A useful representation of these hypotheses should be visible in the Law of One Cost, which fills in as a basic guideline of both Outright and Relative PPP. This regulation declares that in a cutthroat market, the cost of a given decent ought to be the equivalent when changed over into a typical cash. For example, in the event that an item is essentially less expensive in one country than another, exchange valuable open doors emerge as brokers purchase the less expensive item and sell it at a greater cost somewhere else, driving costs once more into harmony. Nonetheless, true intricacies, for example, contrasting charges, taxes, and shopper inclinations can make industrious cost incongruities that challenge the Law of One Cost.

Explanation of Theories with Example

To additionally show these ideas, the Large Macintosh File has acquired fame as a casual proportion of PPP. Created by The Financial expert, this list looks at the cost of a Major Macintosh in different nations as a method for delineating whether monetary standards are underestimated or exaggerated. For example, on the off chance that a Major Macintosh costs $5 in the U.S. however, just $3 in India, this proposes that the Indian rupee might be underestimated contrasted with the dollar. While the Huge Macintosh File is a cheerful way to deal with estimating buying power, it successfully features the more extensive standards of PPP and fills in as a functional utilization of the basic hypotheses.

Limitations of Theories

In spite of the hypothetical groundworks of PPP, there are a few limits that ought to be recognized. One critical test is the presence of non-tradable labor and products, which can prompt significant cost contrasts that PPP computations can’t represent. For instance, lodging costs in metropolitan communities can differ generally because of neighborhood interest and supply factors, making it hard to apply the Law of One Cost. Moreover, social contrasts and customer inclinations can impact estimating, prompting varieties that contort PPP appraisals. Also, market flaws like syndications, unofficial laws, and shifting degrees of contest can additionally muddle the connection among costs and trade rates. These variables frequently bring about a dissimilarity from the hypothetical expectations of Outright and Relative PPP, highlighting the intricacies of worldwide exchange and cash valuation.

Use Of Speculations

Practically speaking, PPP adding machines use these speculations to give clients experiences into the overall buying force of various monetary standards. By contributing information on cost levels, expansion rates, and trade rates, these number crunchers can offer assessments of fair trade rates in light of the standards of PPP. Nonetheless, clients should be wary in deciphering these outcomes, as the limits of the hidden speculations can prompt mistakes, especially temporarily.

Conclusion

In conclusion, the hypotheses encompassing Buying Power Equality, in particular Outright and Relative PPP, give fundamental systems to grasping cash valuation and monetary correlations across nations. While these hypotheses offer significant experiences, the intricacies of genuine business sectors and the restrictions of the fundamental suspicions require a nuanced approach while using PPP mini-computers. By perceiving both the qualities and shortcomings of these speculations, financial analysts and policymakers can all the more likely explore the difficulties of worldwide financial matters and settle on additional educated choices.